Culture: The EU has rules to protect the audio-visual sector from non-EU takeovers and to allow public subsidies; this exemption from usual EU rules is in particular valued by France where it as seen as a safeguard against the French film industry being taken over by Hollywood. The French Government has suggested that it would veto an agreement that did not exclude culture (see below for further details).

Civil aircraft: The granting of subsidies to manufacturers of large civil aircraft in the US and the EU was governed from 1992 to 2004 by a bilateral agreement which reflected the fact that Boeing (USA) and Airbus (EU) are the two largest manufacturers of civil aircraft in the world. The US decided to withdraw from this agreement in 2004 and refer the matter to the WTO which ruled that both parties had broken the rules on subsidies. Discussions continue as the EU adopted counter-measures against the US in 2012.

Defence: defence equipment is a contentious area in international trade and particularly so for the USA and the EU because they are the world’s key centres of design and manufacture of such goods. The US Congress has in the past been inclined to favour a buy USA policy in this field and several EU Member States are keen to protect their national defence industrial sector from US competition.

Services: negotiating better access for services (both ways) will be challenging, as barriers to services generally involve behind-the-border regulatory issues. In the EU, some of these concern regulation that has not yet been harmonised via the Single Market. In the US, they include regulation at both federal and sub-federal level, with all the complications of securing agreement from independent federal regulatory agencies, on the one hand, and individual US states, on the other. And services include some contentious sectoral issues, among them widening transatlantic differences in financial services regulation.

Other obstacles: other areas of dispute include the financial transactions tax, with US objections to the extra-territoriality provisions in the current proposals, air services, coastal shipping, the EU’s data protection rules and inward investment being frustrated by national rules. There are some significant cultural differences between the EU and the USA, for example over labour and consumer rights, that provoke dispute. The question of metric labelling is also an issue; US Federal law currently prohibits metric only labelling and requires both metric and US customary weights (similar to but not the same as UK imperial measures). This led the EU in 2009 to adopt a measure allowing supplementary labelling with non-metric measures in order to help companies exporting to the US (and the UK too). Differences over environmental standards also form an obstacle to agreement.

Current trends

Doha rounds

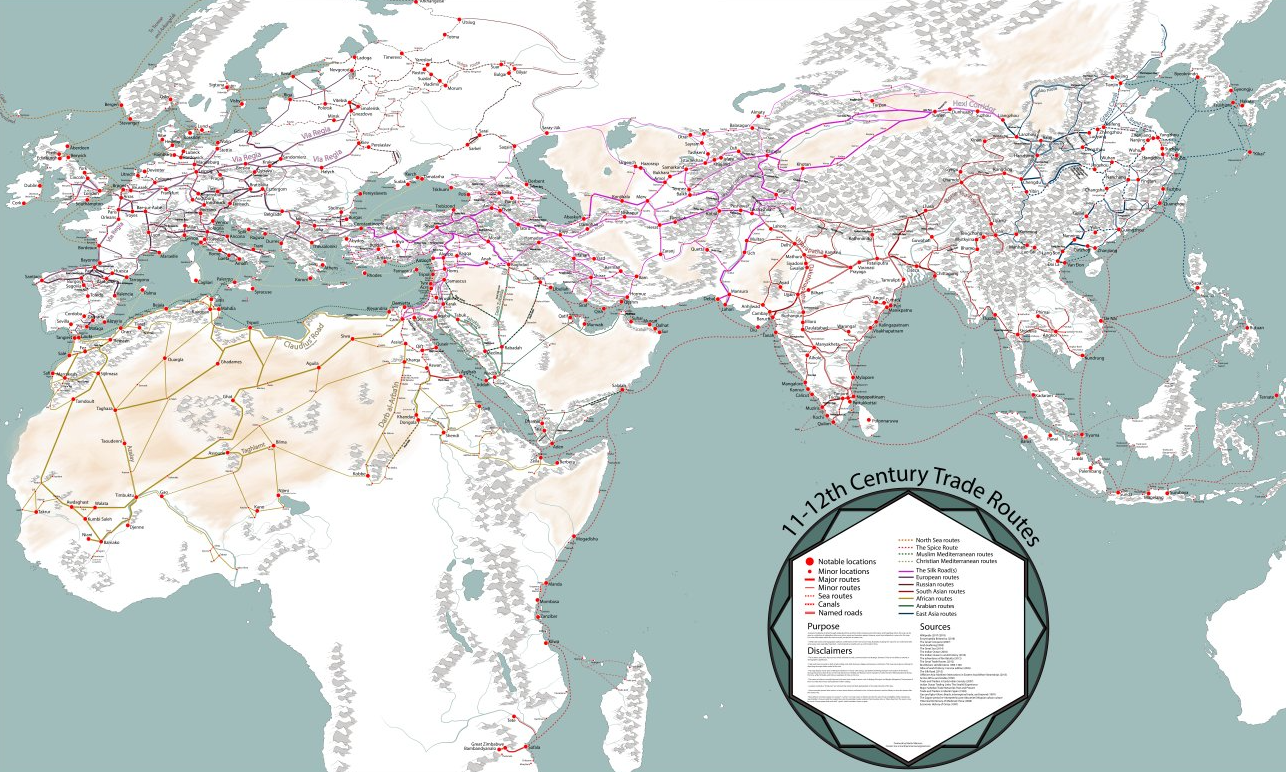

The Doha round of World Trade Organization negotiations aims to lower barriers to trade around the world, with a focus on making trade fairer for developing countries. Talks have been hung over a divide between the rich, developed countries, and the major developing countries (represented by the G20). Agricultural subsidies are the most significant issue upon which agreement has been hardest to negotiate. By contrast, there was much agreement on trade facilitation and capacity building. The Doha round began in Doha, Qatar, and negotiations have subsequently continued in: Cancún, Mexico; Geneva, Switzerland; and Paris, France and Hong Kong.

China

Beginning around 1978, the government of the People's Republic of China (PRC) began an experiment in economic reform. Previously the Communist nation had employed the Soviet-style centrally planned economy, with limited results. They would now utilise a more market-oriented economy, particularly in the so-called Special Economic Zones located in the Guangdong, Fujian, and Hainan. This reform has been spectacularly successful. By 2004, the GDP of the nation has quadrupled since 1978 and foreign trade exceeded $1 trillion US.

As of 2005, China had become the 3rd largest exporter behind Germany and the United States. This occurred in spite of the backlash from the shootings following Tiananmen Square protests of 1989. The PRC maintains a $29 billion trade surplus, and is rapidly becoming a leader in industrial manufacturing. In 1991 the PRC joined the Asia-Pacific Economic Cooperation group, a free-trade organisation. More recently, in 2001 they also joined the World Trade Organization. And now in 2015, with a decade of unprecedented economic growth, China is now entering a new era of economic, social and political development, impacted by its new position as the world’s second largest economy, with a booming middle class population but crippling environmental concerns. One Belt, One Road should strengthen this position.

|

Xi Jinping's Visit to the EU: A triumph of economic diplomacy

The 10-day European tour by the Chinese President Xi Jinping March 2014, ended with his visit to Belgium and the headquarters of the European Union, making him the first Chinese head of state to visit the EU institutions since the establishment of diplomatic relations between the two sides in 1975.

After reinforcing political and economic ties with the Netherlands, France and Germany and signing agreements worth billions of Euros, President Xi Jinping landed in Brussels not only to stress the importance of enhancing cooperation with Belgium but also to boost trade relations between Beijing and the 28 Member States as a block. In his speech for the College of Europe in Bruges, President Xi stated that China’s relations with the EU are to be considered one of the most important bilateral relations in the world which has considerable potential to be further developed.

Although the EU is China’s main trading partner and China is the EU’s most important source of imports, relations between the two global actors had soured during recent months with disputes over dumping, mainly regarding the solar panel and the wine incidents. During President Xi’s visit to Brussels, President Herman Van Rompuy and President Jose Manuel Barroso welcomed him at the European Council and the European Commission respectively. Following these meetings, the joint statement on “Deepening the EU-China Comprehensive Strategic Partnership for mutual benefit” was issued. In the joint statement the two sides renewed their pledge to work together for further strengthening EU-China relations over the next decade. President Xi then continued his official visit at the European Parliament, where Martin Schulz praised the supportive role of China in Europe’s recovery in the midst of the crisis.

With Xi Jinping’s return to Beijing, on 2 April 2014, China issued its second policy paper on the EU, which comes over a decade after the first EU-related policy paper, published in October 2003. In the paper's section IV (on Economic Cooperation and Trade), China stresses the importance of a long-term in-depth development of economic and trade relationships with the EU through already existing tools, such as China-EU High-Level Economic and Trade Dialogue, the China-EU Economic and Trade Joint Committee and other mechanisms. At the same time, China highlights the fact that the EU should commit to resolving economic and trade frictions with China through dialogue and consultation and consider the possibility of a future China-EU FTA.

|

|