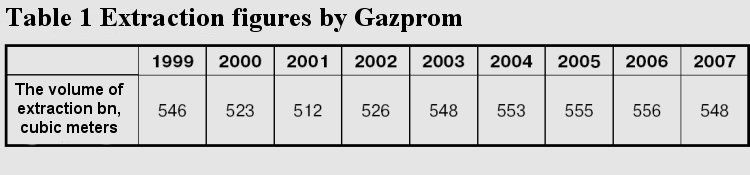

| The winter of 2007-2008 was featured with a top record of daily extraction of the gas from underground storages – that’s 583.6 million of cubic meters per day, which is higher than the record of the really cold winter of 2005-2006. This shows how much the wintertime demand for gas has grown even under conditions of relatively mild winters. One may suppose the threatening consequences to affect Russia in case one of the next winters is really cold. One should expect large-scale cutting off of the vitally important facilities due to the gas shortage.

Similar picture we could see in the winter 2005-2006 where mass restriction of gas supplies had to be imposed on the consumers. According to the RAO EES, the total restrictions of the gas supplies to the Russian electric power stations on the cold days of January-February 2006 was 12.5% against the target volumes for the entire United Energy System and up to 80-83% for the power stations of the central region and the North-West.

In other word, there was almost complete turning off of gas supplies to power stations in the European part of Russia (should it be reminded that the gas is the dominating fuel used for producing electric energy in Russia?). In January-February 2006 there was a serious tension also about export gas supplies. According to information by the media, on 18 January 2006 Gazprom decreased voluntarily the volume of transit of the gas through Ukrainian territory from 390 to 350 million cubic meters per day due to shortage of the gas.

Same day Gazprom informed its Italian partner, the ENI Concern, of its incapability to guarantee the gas supplies in the planned volume due to extremely cold temperatures, after which restrictions of Gazprom supplies were reported by Serbia (25%), Croatia (6-10%) and Hungary (20%).

The reason for stagnation of the gas supplies in the home market against the background of the growing demand is a systemic shortage of investments into extraction. Russia possesses sufficient stock of the proved reserves of the gas, which should be enough for the next 80 years with today’s level of the extraction. However, many of those fields are not explored.

Significant part of the reserves is concentrated in the fields in the new unexplored areas where there is no developed infrastructure and this is why those areas are so difficult for exploration. For example, to explore the fields in the peninsula of Yamal situated at a distance of 500-600 km to the north of the standing regions of the gas extraction, it takes construction of a 540 km long railroad that is to pass permafrost areas and the lands waterlogged for 50-60%, featured with a lot of small rivers and streams. To deliver the gas from the peninsula of Yamal it is necessary to build a gas pipeline with the length of 1,100 km, underwater part of which is also to pass on the permafrost and waterlogged territories.

According to licenses given, Gazprom was to put those fields in operation at the late ‘90s. However, nothing real has been done about that. In 2000 the former head of Gazprom Rem Vyakhirev asked for prolongation of the licenses. He was refused first, however, after appointment of Alexei Miller to be the head of the company, the license terms were postponed for 8-12 years in a quiet way and without any explanations given. And now even those terms are going to be unmet.

Against the background of declining volumes of extraction at the old gas fields, put into operation as far back as 1980s, Russia is going to face a threatening problem of the gas deficit. The Yuzhno-Russkoe field is the last relatively large field remaining in the standing area of the extraction where the infrastructure is rather well developed and conditions of extraction are more favorable. The “new gas” will have to be taken from unexplored fields, one of the most complicated in the world, where exploration and making the necessary infrastructure will require vast investments. According to fresh estimation by Gazprom itself, the cost alone of the construction of the Bovanenkovo-Ukhta pipeline will be $80-90 Bn, while the entire project of exploration of the Yamal may take an amount of up to $200 Bn, which is more than all the Russian Stabilization Fund!

Why all those investments haven’t been done so far, considering it was planned that the gas from Yamal gas fields was to be delivered to the continent at the late ‘90s? The problem is that over all these years Gazprom intentionally has spent only relatively minor means on investments into its profile business, i.e. gas extraction. The vast super profits, gained out of rapid growth of the export and domestic gas prices, Gazprom has spent on buying up the assets and on financing the rapidly growing costs. That way, within the period from 2001-2007 only slightly over $27 Bn have been spent by the Company on the capital investment of its main business, the gas extraction.

Just compare: in 2003-2007 Gazprom has spent $44.6 Bn on buying the assets. Over $30 Bn in that amount were assets having no relation to the gas industry. That’s mainly oil companies (Sibneft, Tomskneft) and electric energy companies (RAO EES, Mosenergo, wholesale and territorial generating companies), also Rosukrenergo trader. If those means had been spent on exploration of the new gas fields, Russia would not be posed a threat of the gas supplies crisis.

While the fields in Yamal are not getting explored yet, Gazprom has got into dependence on the gas import from the Central Asia. If in 2002 the share of the Central Asian gas was slightly over 4% in the Gazprom balance, now the figure is 8%. In the meantime, this gas is going up rapidly. In 2003 a thousand cubic meters of the Turkmen gas cost to Gazprom $30. Today the price is $150. And since 2009 on, the figure may become $250 or even higher.

No wonder that the financial report of Gazprom for 2007, made in accordance with the international standards, has shown a paradoxical result: with the growth of proceeds of more than 8% out of the gas selling, the profits out of selling have reduced for 11%. And this figure appeared against the background of steady growth of gas sales in 2007, including 22.5% for the Russian consumers and the average 25.2% for the CIS countries.

How can it have been shown reduction of profits out of sales with the rapid growth of prices? The Gazprom’s management makes no secret out of the fact that the reason is the growth of costs, where the main article is buying up the gas from the third persons (cost of such buying has increased for 36%). If in 2003 the expenses for bought oil and gas were less than a billion dollars, in 2007 the figure was $15 Bn or more than a quarter of all the operational costs by the Company! The biggest share of those costs is rapidly growing costs for buying the gas in the Central Asia: a bit over $ 1 Bn in 2006; $7.5 Bn in 2006; $11.7 Bn in 2007.

In March 2008 the heads of the petroleum companies from Kazakhstan, Uzbekistan and Turkmenistan advised Gazprom that since January 2009 they are going to change for the new tariffs of the gas supplies, making it proportionate to the European prices. That means, the purchasing prices may reach the limit of 250-300 dollars per one thousand cubic meters. Thus, the costs for buying the Central Asian gas will increase to $17-21 Bn per year.

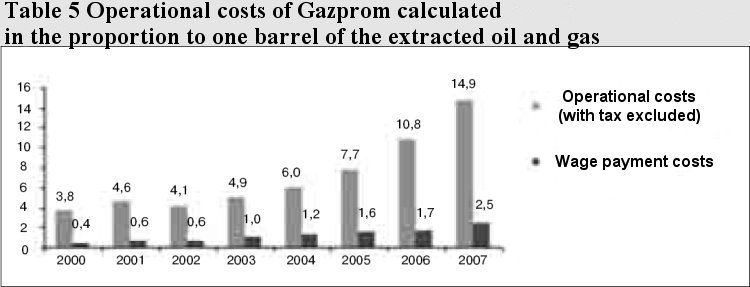

There is another problem hindering the increase of investments into gas extraction, that’s a very low economic effectiveness of the activities by Gazprom. The operational costs of the Company (with taxes excluded) have increased as many as three times compared to the year 2003: from $4.9 to $14.8 per barrel.

Besides the growth of costs for the bought gas, the rising figure of the wage payment is another article of the expenses increased. The figure has gone up from $3.7 Bn in 2003 to $9.7 Bn in 2007, or counting it in barrels of the extracted oil equivalent this is the change from less than $1 per barrel in 2003 to $2.5 in 2007. Gazprom headcount has been constantly increasing, going from 391,000 in 2003 to 445,000 in 2007.

To be able to finance its growing appetite on buying the assets and to pay the growing costs, Gazprom has got indebted greatly. The Company’s debt that was $13.5 Bn at the end of 2000 reached the figure of $61.6 Bn or 66% (two thirds) of the annual proceeds. It should be noted that with the international petroleum companies the normal figure of proportion of the debt to the annual proceeds is considered to be no more than 10-15%. Vast payments for servicing the debt hinder the investments. Moreover, there is a risk that in case of aggravation of the export price conjuncture Gazprom would have to reduce investments or even go bankrupt.

Possible consequences then would be accelerated price rise for gas for the home consumers, worsening the crisis in the gas extraction and probable spending of the state financial resources made for getting Gazprom avoid the bankruptcy. So it turns out that the gas resources lying in the depths and allegedly belonging to people, in reality are disposed of by a narrow circle of persons who are close to the country’s leadership. |